can you go to jail for not filing taxes for 5 years

So there are a number of situations where you could face jail time if you fail to file your taxes. What happens if you get caught not filing taxes.

Here S What Happens When You Don T File Taxes

However you can face jail time if you commit tax evasion tax fraud or do not file your taxes.

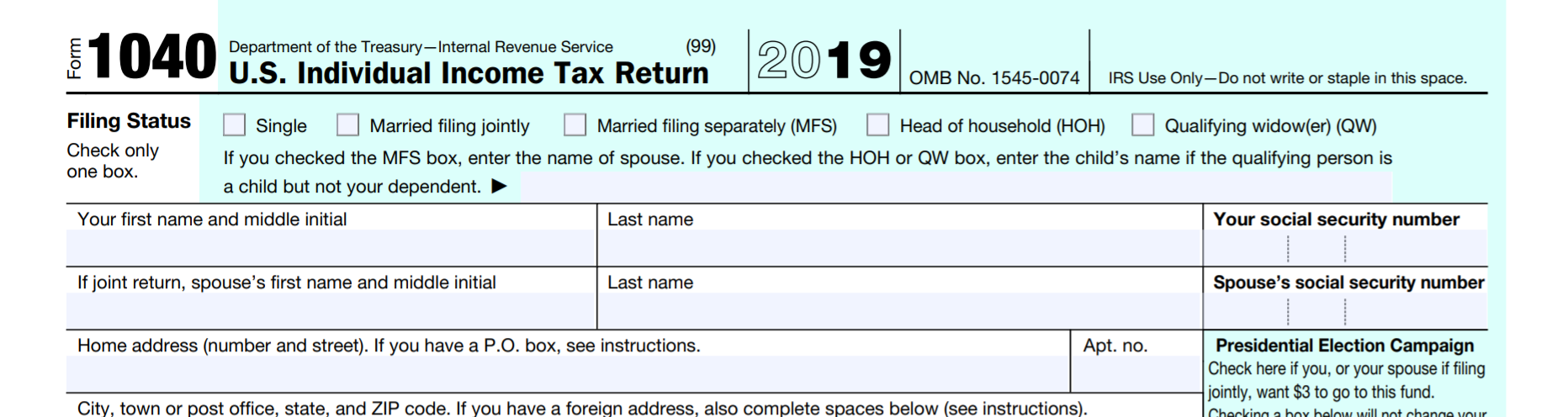

. Failure to file or failure to pay tax could also be a crime. Misrepresent their income and credits in their. For each years portion of your unpaid tax bill the IRS can pursue collection.

Any action taken to evade the assessment of a tax such as filing a fraudulent return can land you in prison for 5. Helping Someone Evade Taxes. Can you go to jail.

Although you will not go to jail for not paying taxes neglecting back taxes can still have serious consequences. Failure to File a Return. This means that while you cant be put in jail for not.

The following actions can land you in jail for one to five years. Helping someone else get out of paying. May 4 2022 Tax Compliance.

For not paying state taxes you will most likely end up with a fine. If you dont file federal taxes youll be slapped with a penalty fine of 5 of your tax debt per month that theyre late capping at 25 in addition to however much money you may owe. The question can you go to jail for not filing taxes is complicated and multifaceted.

To be convicted of these crimes your behavior must. These include if you simply fail to file your taxes because you forgot or were late. Failing to file a return can land you in jail for one year for each year you didnt file.

Anyone who files a fraudulent tax return faces a 5-year. What to Do If You Owe Back Taxes. 465 9 votes Tax Evasion.

The penalty is usually 5 of the tax owed for each month or part of a month the return is late. Failure to File a Return. Further if you are caught helping someone evade paying taxes.

Yes you can go to jail only if you have violated state tax law and participated in tax fraud. If you wish to claim your tax refund you have three years from that years tax return due date to file it. Although it is very unlikely for an individual to receive a jail sentence for.

Under the Internal Revenue Code 7201. The CRA will charge a late-filing penalty of 5 if you dont file your tax returns by April 30 plus an additional 1 for every month after that date until you pay up to 12 months. For example the IRS can.

Failure to File a Return. The short answer is yes you can go to jail for not paying taxes. The IRS recognizes several crimes related to evading the assessment and payment of taxes.

Fail to file their tax returns Failing to file your tax returns can land you in jail for up to one year for every year that you failed to file your taxes. In fact you may face a year in jail uncommon for each year you did not file. The maximum failure-to-file penalty is 25.

If you have committed tax evasion or assisted someone else in committing tax evasion you should expect to go to jail. There is no deadline however on the IRS for going after nonfilers and imposing civil penaltiesin addition to any taxes owed. These crimes can lead to a prison sentence of up to five years and fines up to 250000 for individuals and 500000 for corporations.

If you have unpaid. Any action taken to evade the assessment of a tax such as filing a fraudulent return can land you in prison for 5 years. The short answer is maybe.

What Happens If I Filed My Taxes Wrong A Complete Guide Ageras

How To File Your Taxes If Your Spouse Is Incarcerated

Can You Go To Jail For Not Filing A Tax Return Damiens Law Firm

Is Jail A Possibility If You Fail To Pay Your Taxes Frost Law Maryland Tax Lawyer

How To Avoid Jail When You Owe Back Taxes

Can The Irs Really Send Me To Jail For Unpaid Taxes Levy Associates

Delinquent Or Unfiled Tax Return Consequences For Irs Taxes

![]()

Delinquent Or Unfiled Tax Return Consequences For Irs Taxes

Preparing Tax Returns For Inmates The Cpa Journal

When Will The Irs File Federal Charges Against You Tax Debt Relief Services

I Haven T Filed Taxes In 5 Years How Do I Start

Expect Long Delays In Getting Refunds If You File A Paper Tax Return Tax Policy Center

Irs Audit Penalties And Consequences Polston Tax

Tax Fraud In Texas Could Land You A Jail Sentence Fulgham Law Firm

When Will The Irs File Federal Charges Against You Tax Debt Relief Services

What Happens If You Don T File Taxes For 10 Years Or More Findlaw

Can You Go To Jail For Debt Experian